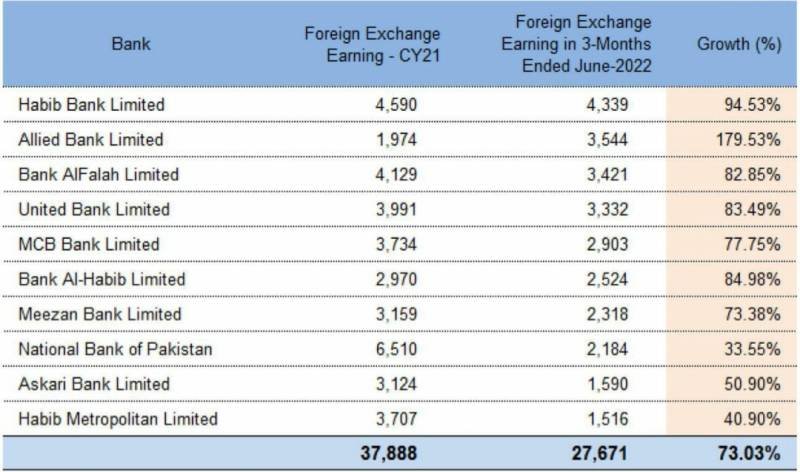

The State Bank of Pakistan (SBP) has pinpointed the involvement of eight Pakistani banks in an unprecedented surge in the US dollar rate in Pakistan. The names of these banks have been forwarded to the National Assembly Standing Committee for further action. Remarkably, these banks exceeded their full fiscal year 2021-22 profits in just the first quarter. Habib Bank Limited, Allied Bank Limited, Bank Alfalah Limited, United Bank Limited, MCB Bank Limited, Bank Al Habib Limited, Meezan Bank Limited, National Bank of Pakistan, Askari Bank Limited, and Habib Metropolitan Bank reportedly recorded a profit of Rs27.8 billion from foreign exchange during the first quarter of the fiscal year 2022-23.

Despite the SBP and Pakistan’s Finance Ministry being responsible for regulating banks in Pakistan, they were seemingly ineffective in this case. Recent media reports suggest that these banks, along with some money exchange companies, exacerbated the situation as the US dollar started leaving Pakistan following a successful regime change operation in the country. For instance, Allied Bank’s income from foreign exchange in the first three months of 2022 was 79.55% higher than its earnings in all of 2021. Similarly, HBL’s foreign exchange income during the same three-month period was 94.55% of its total 2021 income.

Former finance minister of Pakistan, Miftah Ismail, often attributed the rising dollar rate to “market fundamentals” or “economic fundamentals.” Now, the new Finance Minister, Ishaq Dar, has pledged to bring the US dollar rate below Rs200. While a fair analysis suggests that one US dollar should equal Rs190 or Rs195, the ground reality paints a different picture. There are indications that more banks involved in this scandal may emerge in the coming days.